Fiberglass Market 2024: Global Industry Overview, Trends, and Opportunities USD 31.58 Billion

The Fiberglass Market continues to grow as industries embrace advanced composites, driving innovations in automotive, aerospace and renewable energy sectors.

Fiberglass composites are revolutionizing renewable energy, construction, and electronics, offering lightweight, durable, and high-performance solutions globally.”

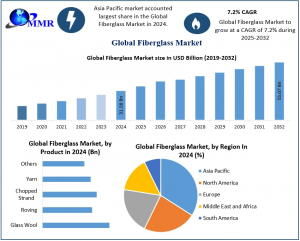

WILMINGTON, DE, UNITED STATES, October 17, 2025 /EINPresswire.com/ -- The Fiberglass Market, valued at USD 31.58 Billion in 2024, is projected to reach USD 55.07 Billion by 2032, growing at a CAGR of 7.2%. Explore key trends, applications, and competitive landscape driving growth across renewable energy, automotive, construction, and electronics sectors.— Dharti Raut

Fiberglass Market is experiencing a transformative surge, driven by rising adoption in renewable energy, automotive, construction, and electronics sectors. In wind energy, modern blades made from marine-grade E-glass fibers reduce processing time by over 50% and cut production costs by nearly 40%, enabling onsite installation even in low-speed regions. Asia-Pacific leads consumption, with China producing 60% of global fiberglass, India recording 35% growth in construction-related use, and Japan and South Korea expanding automotive and electronics applications. The global PCB market, valued at USD 62.1 billion, increasingly relies on fiberglass textiles for superior insulation and heat resistance in aerospace, telecom, and medical electronics. Across end-use industries, E-glass dominates, while polyester, epoxy, and vinyl ester matrices enhance mechanical and thermal durability. As companies like Owens Corning, Saint-Gobain, and China Jushi drive innovation, the Fiberglass Industry is becoming the backbone of lightweight, durable, and energy-efficient solutions worldwide, positioning it as a critical material for the next wave of industrial and renewable energy growth.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/2602/

Inside the Fiberglass Boom: From Wind Farms to Smart Tech Circuits

The Fiberglass Industry is undergoing a manufacturing revolution led by two powerhouse sectors renewable energy and electronics. Modern fiberglass blades, crafted with marine-grade E-glass fibers, are cutting processing times by over 50% and reducing blade production costs by nearly 40%, according to MMR. Lightweight structures allow onsite installation, lowering logistics expenses and enabling wind energy generation even in low-speed regions. The Asia-Pacific region especially China (188 GW installed capacity), India, and Australia dominates global wind expansion, with global wind capacity reaching 739 GW by 2022, signaling fiberglass’s indispensable role in the clean energy transition.

At the same time, fiberglass-reinforced PCBs are redefining the electronics and semiconductor landscape. The global PCB market, valued at USD 62.1 billion, relies heavily on fiberglass textiles for superior insulation and heat resistance. These materials ensure perfect electrical resistance in high-pressure laminates used in automotive, aerospace, telecom, and medical electronics. With rising consumer electronics adoption, industrial automation, and smart defense systems, fiberglass is evolving beyond a composite material it’s the foundation of high-performance, durable, and energy-efficient innovation across modern industries.

Fiberglass Market Segments: Strength in Versatility and Application

Based on glass type, E-glass dominated the Fiberglass Market in 2024, accounting for the largest share due to its high tensile strength, lightweight structure, and corrosion resistance. It’s widely adopted in wind turbine blades, marine components, and automotive body panels, offering a 40% cost reduction and 50% faster processing than conventional composites. Other glass types such as S-glass, A-glass, R-glass, and ECR-glass are gaining traction in aerospace and defense applications, where superior mechanical properties are vital for safety and performance.

By resin type, polyester and epoxy resins lead the segment due to their excellent bonding with glass fibers, enhancing thermal and mechanical durability. Vinyl ester and thermoplastic matrices are also expanding their footprint across construction and transportation, favored for recyclability and structural stability.

In terms of end-use industries, construction, automotive, wind energy, and electrical & electronics collectively drive the bulk of fiberglass consumption. The Asia-Pacific region, led by China and India, remains the largest consumer as rapid urbanization and renewable energy investments accelerate demand for fiberglass composites in infrastructure and electronics.

Feel free to request a complimentary sample copy or view a summary of the report @ https://www.maximizemarketresearch.com/request-sample/2602/

Regional Analysis: Asia-Pacific Leads, North America Advances

The Asia-Pacific Fiberglass Market dominates global demand, with China producing over 60% of global fiberglass, supported by 200+ manufacturing plants specializing in E-glass and chopped strand mats. India has seen 35% growth in construction-related fiberglass consumption, driven by urban development and energy-efficient projects. Japan and South Korea leverage fiberglass composites in automotive and electronics, strengthening the region’s manufacturing supply chain.

North America focuses on innovation and sustainability, with 13 GW of U.S. wind turbines in 2023 using fiberglass-reinforced blades. Europe produces 1.2 million tons of fiberglass-reinforced plastics, with Germany, France, and the U.K. leading aerospace and construction adoption. These trends confirm the Fiberglass Industry is central to renewable energy, high-performance manufacturing, and infrastructure growth worldwide.

Recent Developments in the Fiberglass Industry

June 17, 2024: TPI Composites announced the divestiture of its automotive business unit to concentrate on the wind energy sector. This strategic move underscores the company's commitment to fiberglass composites in renewable energy applications.

March 17, 2025: Research demonstrated that extending post-curing at 100°C for 24 hours after an initial 3-hour cure at 130°C increases tensile strength by 60% and elongation by 164% in epoxy resin composites, highlighting advancements in fiberglass composites manufacturing processes.

September 15, 2025: A study introduced modular fiber-optic assemblies for multi-parameter sensing, enabling real-time monitoring of temperature and vibration in fiberglass composites, enhancing predictive maintenance and performance optimization.

Fiberglass Industry Trends

Rising adoption of fiberglass composites in wind turbine blades for lightweight, high-strength renewable energy applications.

Increasing use of E-glass textiles in automotive and aerospace sectors to reduce vehicle and aircraft weight.

Expansion of fiberglass-reinforced printed circuit boards (PCBs) in electronics, telecom, and defense industries.

Advances in epoxy resin and vinyl ester matrices enhancing durability, thermal resistance, and mechanical performance.

Growing trend of sustainable and eco-friendly fiberglass materials in construction and infrastructure projects.

Integration of fiber-optic sensing technologies in fiberglass composites for real-time monitoring and predictive maintenance.

Competitive Landscape: Leading Players Driving Fiberglass Innovation

The global Fiberglass Industry is highly competitive, with major players shaping technological advancements and market growth. China Jushi, Xingtai Jinniu Fiberglass, and Glasstex Fiberglass dominate Asia-Pacific production, focusing on E-glass and fiberglass composites for wind energy, automotive, and construction applications. In North America, companies such as Hexcel Corporation, Owens Corning, and PPG Industries lead innovation in fiberglass textiles for aerospace, electronics, and infrastructure projects. For instance, Owens Corning’s Guangzhou plant in China has a production capacity of 24,000 tons per year. European firms like Saint-Gobain, Gurit, and Chomarat emphasize R&D in high-performance fiberglass materials for defense and industrial applications. Strategic partnerships, capacity expansions, and investment in lightweight, durable fiberglass composites are accelerating adoption across renewable energy, construction, and electronics globally.

Fiberglass Market Key Players

North America

Hexcel Corporation (U.S.)

Fibre Glast Developments Corp. (U.S.)

PPG Industries (U.S.)

Owens Corning (U.S.)

Phelps Industrial Products LLC. (U.S.)

Agy Holdings Corp. (U.S.)

CertainTeed Corporation (U.S.)

Auburn Manufacturing, Inc. (U.S.)

BGF Industries, Inc. (U.S.)

Dupont (U.S.)

Johns Manville Corp. (U.S.)

Europe

3B-The Fiberglass Company (Belgium)

Knauf Insulation (Belgium)

Gurit (Switzerland)

Chomarat (France)

Saint-Gobain (France)

Saertex GmbH & Co.KG. (Germany)

Asia-Pacific

China Jushi Co., Ltd. (China)

Xingtai Jinniu Fiberglass (China)

Glasstex Fiberglass (China)

Chongqing Polycomp International Corporation (China)

Jushi Group Co., Ltd (China)

Taishan Fiberglass (China)

Nitto Boseki Co., Ltd. (Japan)

Nippon Electric Glass (Japan)

Asahi Fiberglass Co (Japan)

PFG Fiber Glass (Taiwan)

Taiwan Glass Ind. (Taiwan)

FAQs on the Fiberglass Market

Q1. What is driving the growth of the Fiberglass Market?

The Fiberglass Market growth is driven by rising demand from construction, wind energy, automotive, and electronics industries. Its lightweight, corrosion-resistant, and durable nature makes it ideal for modern infrastructure and renewable energy applications.

Q2. Which industries are major consumers of fiberglass products?

Key sectors include aerospace, marine, automotive, electrical, and building materials. The global Fiberglass Industry is expanding rapidly in Asia-Pacific due to large-scale renewable and infrastructure projects.

Q3. What are the latest Fiberglass Market trends?

The Fiberglass Market trends highlight innovations in E-glass composites, smart PCBs, and eco-friendly manufacturing. Increasing adoption of fiberglass-reinforced plastics (FRP) for lightweight components and sustainable products is shaping future demand.

Q4. Which companies lead the global Fiberglass Market?

Leading fiberglass manufacturers include Owens Corning, Saint-Gobain, Jushi Group, and Nippon Electric Glass, all investing heavily in advanced composite technologies.

Related Reports:

Non-Stick Coatings Market https://www.maximizemarketresearch.com/market-report/non-stick-coatings-market/187696/

Steel Fiber Market: https://www.maximizemarketresearch.com/market-report/global-steel-fiber-market/28288/

Maximize Market Research is launching a subscription model for data and analysis in the Automotive and Transportation Industry: https://www.mmrstatistics.com/markets/318/automotive-and-transportation

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

Lumawant Godage

MAXIMIZE MARKET RESEARCH PVT. LTD.

+ +91 96073 65656

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.