Global Canned Alcoholic Beverages Market Projected to Surpass USD 271.26 Billion by 2034, Expanding at 13.34% CAGR

Global canned alcoholic beverages market valued at USD 88.25 billion in 2025 is projected to reach USD 271.26 billion by 2034, growing at a CAGR of 13.34%.

The canned alcoholic beverages market is set to grow from USD 88.25 billion in 2025 to USD 271.26 billion by 2034, driven by RTD demand, premiumization, and sustainable packaging.”

PUNE, MAHARASHTRA, INDIA, February 4, 2026 /EINPresswire.com/ -- The global canned alcoholic beverages market size was valued at USD 88.25 billion in 2025. The market is projected to grow from USD 99.61 billion in 2026 to USD 271.26 billion by 2034, exhibiting a CAGR of 13.34% during the forecast period. North America dominated the market with a share of 52.39% in 2025.— Fortune Business Insights

Canned alcoholic beverages include ready-to-drink (RTD) cocktails, hard seltzers, canned wines, and spirits-based drinks packaged in aluminum cans for portability, convenience, and sustainability. The market is expanding rapidly due to shifting consumer lifestyles, growing preference for low-alcohol beverages, innovative flavor profiles, and eco-friendly packaging solutions.

The format strongly appeals to Millennials and Gen Z consumers seeking convenient, trendy, and socially adaptable beverage options. Premiumization, recyclable aluminum packaging, and rising online retail availability are further accelerating global consumption.

Major players operating in the market include Anheuser-Busch InBev SA/NV, Diageo plc, Pernod Ricard SA, Brown-Forman Corporation, Asahi Group Holdings, Ltd., and others.

Get a Free Sample PDF Here: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/canned-alcoholic-beverages-market-114514

Market Dynamics

Market Drivers

Rising Popularity of Ready-to-Drink (RTD) and Convenient Alcoholic Formats

The increasing demand for RTD alcoholic beverages is a primary driver of market growth. These premixed drinks eliminate preparation, making them ideal for outdoor activities, travel, social gatherings, and on-the-go consumption. Their convenience aligns well with modern, fast-paced lifestyles.

Spirit-based RTDs and premixed cocktails have seen strong revenue growth, reinforcing consumer preference for canned formats that offer consistent taste, portability, and ease of consumption.

Market Restraints

Stringent Alcohol Regulations and Taxation

Strict alcohol regulations related to production, labeling, distribution, and advertising pose significant challenges. Varying taxation structures, age restrictions, and alcohol content limits restrict product innovation and market entry, particularly in emerging economies and regulated regions.

Higher excise duties on RTDs compared to traditional beer in several countries further constrain pricing flexibility and demand growth.

Market Opportunities

Expansion of E-Commerce and Direct-to-Consumer (DTC) Channels

The rapid growth of e-commerce and DTC channels presents strong opportunities for market expansion. Online platforms enable broader geographic reach, brand engagement, and improved accessibility, especially in regions with limited physical retail infrastructure.

Younger consumers show a strong preference for digital purchasing, supporting continued momentum in online alcohol sales.

Canned Alcoholic Beverages Market Trends

Innovation in Flavors and Low-Alcohol Variants

Flavor innovation and low-alcohol product development are key trends shaping the market. Brands are introducing botanical infusions, exotic fruits, herbal notes, and globally inspired cocktail flavors to attract adventurous and premium-seeking consumers.

Low- and mid-ABV canned beverages cater to health-conscious consumers seeking moderation without compromising taste or experience.

Segmentation Analysis

By Product Type

The market is segmented into canned beer, canned wine, canned cocktails, and others.

The canned beer segment dominates, accounting for 46.02% share in 2024 and is projected to hold 45.71% share in 2026, supported by its long-standing consumer base and widespread global consumption.

The canned cocktail segment is expected to grow at a CAGR of 13.90% during the forecast period.

By Alcohol Type

The market is segmented into malt-based, spirit-based, and wine-based beverages.

The malt-based segment led, contributing 53.41% of global revenue in 2025, driven by affordability, production scalability, and flavor versatility. The segment is projected to account for 52.93% share in 2026.

The spirit-based segment is expected to grow at a CAGR of 13.93%.

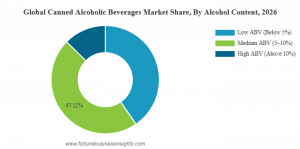

By Alcohol Content

Based on alcohol content, the market includes low ABV (Below 5%), medium ABV (5–10%), and high ABV (Above 10%) beverages.

The low ABV segment dominated in 2024, driven by health consciousness and social acceptability, while the medium ABV segment is projected to lead in 2026 with a 47.11% share.

By Distribution Channel

The market is segmented into on-trade and off-trade channels.

The off-trade segment dominated, accounting for 62.89% share in 2024 and projected to reach 63.15% in 2026, supported by retail, convenience stores, and online platforms.

Canned Alcoholic Beverages Market Regional Outlook

North America

North America led the market with a valuation of USD 46.23 billion in 2025, driven by high consumer spending, strong RTD adoption, and innovation in flavors and packaging. The U.S. remains the dominant contributor.

Europe

Europe exhibits steady growth, driven by premiumization and consumer shift toward convenient alcohol formats. The region is supported by mature alcohol markets transitioning to canned RTDs.

Asia Pacific

Asia Pacific is the fastest-growing region, supported by rising disposable incomes, urbanization, tourism, and growing acceptance of Western-style RTD beverages. China, Japan, and India are key growth markets.

South America and Middle East & Africa

These regions show moderate growth, driven by lifestyle changes, urban consumption patterns, and increasing availability of canned alcoholic beverages in select markets.

Speak to Analysts: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/canned-alcoholic-beverages-market-114514

Competitive Landscape

Key Industry Players

The market is highly competitive, with major global alcohol companies expanding their canned RTD and hard seltzer portfolios. Competition is fueled by product innovation, premium positioning, and sustainable packaging.

Key players include:

Anheuser-Busch InBev SA/NV

Diageo plc

Pernod Ricard SA

Brown-Forman Corporation

Asahi Group Holdings, Ltd.

Key Industry Developments

July 2025: Smirnoff launched new India-focused RTD vodka flavors.

March 2025: The Coca-Cola Company expanded into spirit-based RTDs under Minute Maid.

December 2024: Suntory introduced MARU-HI sparkling cocktails in the U.S.

December 2024: Coca-Cola acquired Billson’s to expand RTD presence in Australia.

Report Coverage

The report provides comprehensive quantitative and qualitative analysis of the global canned alcoholic beverages market, including market trends, competitive landscape, regional outlook, segmentation analysis, and key industry developments.

Future Scope:

The global canned alcoholic beverages market is expected to witness robust growth driven by premium RTD innovations, low- and no-alcohol variants, and functional ingredient integration. Expanding e-commerce, DTC models, and smart packaging will enhance consumer reach and engagement. Emerging markets in Asia Pacific, Latin America, and Africa offer untapped potential due to urbanization and changing lifestyles. Sustainability-focused packaging and personalized flavor offerings will further shape long-term market expansion.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.